In the global chemical landscape, the sodium cyanide market is undergoing significant transformations, driven by two key trends: the growing emphasis on sustainability and the surging demand from emerging economies.

The Push for Sustainability in the Mining Sector

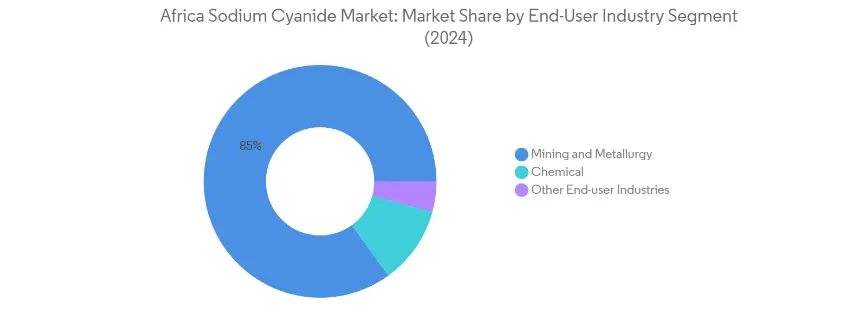

The mining industry, being the largest consumer of sodium cyanide, is under mounting pressure to adopt environmentally friendly practices. This has led to a spike in innovation in cyanide recovery and waste management. Technologies such as in-situ recovery methods are being explored to reduce the environmental footprint of cyanide use. In addition, the search for sodium cyanide alternatives has become a priority for many mining companies.

These initiatives not only mitigate the environmental risks associated with cyanide use but also open up new growth opportunities for market players in the sustainable chemistry space. Companies that invest in research and development to create more sustainable solutions stand to gain a competitive edge in the Sodium Cyanide market.

Rising Demand from Emerging Economies

Emerging economies, particularly in Africa and Asia, are witnessing rapid expansion in the mining and industrial sectors. As these regions continue to develop their resource extraction industries, the demand for Sodium cyanide is expected to rise significantly. The ongoing industrialization in these markets, coupled with the growth of the chemical manufacturing and electroplating industries, is fueling the demand for sodium cyanide across various applications.

Companies that can successfully penetrate these fast - growing markets will enjoy a substantial advantage in the global sodium cyanide arena. Understanding the unique market dynamics and regulatory environments in these regions is crucial for market players looking to capitalize on the emerging opportunities.

In conclusion, the sodium cyanide market is at a crossroads, with sustainability and emerging market growth acting as the primary drivers of change. Companies that can adapt to these trends and develop innovative solutions will be well - positioned to thrive in the evolving market landscape.

- Random Content

- Hot content

- Hot review content

- Unlocking the Power of Mineral Processing Chemicals: Enhancing Efficiency and Sustainability

- calcium chloride anhydrous for food

- Fertilizer magnesium sulfate/magnesium sulfate monohydrate

- Phosphoric Acid 85% (Food grade)

- United Chemical GDA Gold Dressing Agent HS: 3824999999 – Eco-Friendly Substitute for Sodium Cyanide

- Pharmaceutical Grade Zinc Acetate

- Lithium chloride, 99.0%,99.5%

- 1Discounted Sodium Cyanide (CAS: 143-33-9) for Mining - High Quality & Competitive Pricing

- 2Sodium Cyanide 98% CAS 143-33-9 gold dressing agent Essential for Mining and Chemical Industries

- 3China's New Regulations on Sodium Cyanide Exports and Guidance for International Buyers

- 4International Cyanide(Sodium cyanide) Management Code - Gold Mine Acceptance Standards

- 5China factory Sulfuric Acid 98%

- 6Sodium Cyanide (CAS: 143-33-9) End user certificate (Chinese and English version)

- 7Anhydrous Oxalic acid 99.6% Industrial Grade

- 1Sodium Cyanide 98% CAS 143-33-9 gold dressing agent Essential for Mining and Chemical Industries

- 2High Purity · Stable Performance · Higher Recovery — sodium cyanide for modern gold leaching

- 3Sodium Cyanide 98%+ CAS 143-33-9

- 4Sodium Hydroxide,Caustic Soda Flakes,Caustic Soda Pearls 96%-99%

- 5Nutritional Supplements Food Addictive Sarcosine 99% min

- 6Sodium Cyanide Import Regulations & Compliance – Ensuring Safe and Compliant Importation in Peru

- 7United Chemical's Research Team Demonstrates Authority Through Data-Driven Insights

Online message consultation

Add comment: